kentucky car tax calculator

Inquiries on refund status can be sent to motorvehiclerefundkygov or by calling 502-564-8180. Estimate your car payment with our simple to use Loan Calculator.

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

You can find the VIN.

. Dealership employees are more in tune to tax rates than most government officials. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky. Overview of Kentucky Taxes. Hmm I think.

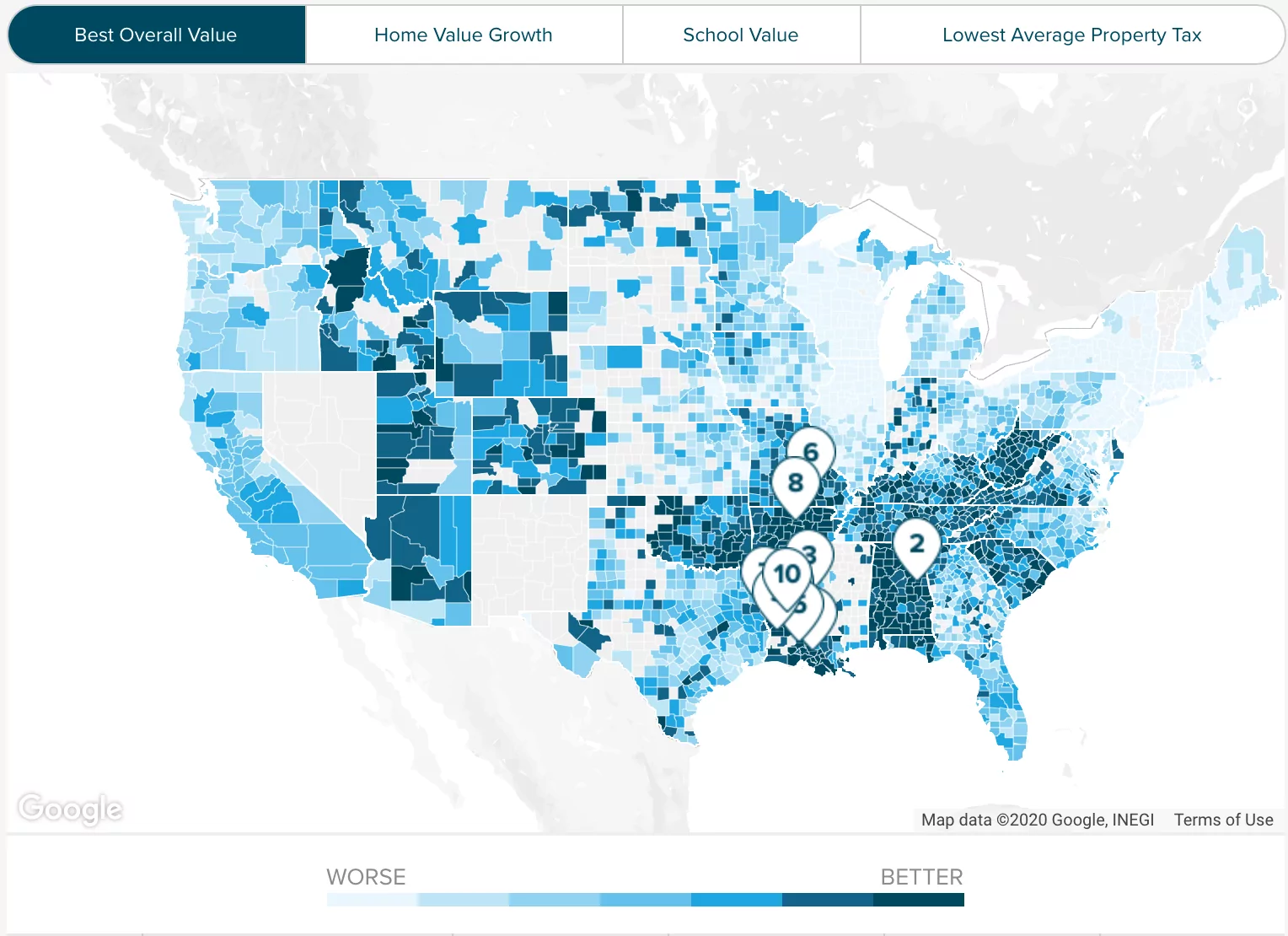

On average homeowners pay just a 083 effective property tax. Please allow 5-7 working days for online renewals to be processed. The information you may need to enter into the tax and tag calculators may include.

You can do this on your own or use an online tax calculator. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. By using the Kentucky Sales Tax Calculator you agree to the.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122. Processing Fees Payment Methods.

The vehicle identification number VIN. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1st of each year. In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including.

The percentage paid is labled a Usage Tax In our calculation the taxable amount is 39175 which equals the sale price of 39750 plus the doc fee of 475 plus the extended warranty cost of 3450 minus the trade-in value of 2000 minus the rebate of 2500. Please note that we can only estimate your property tax based on median property taxes in your area. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

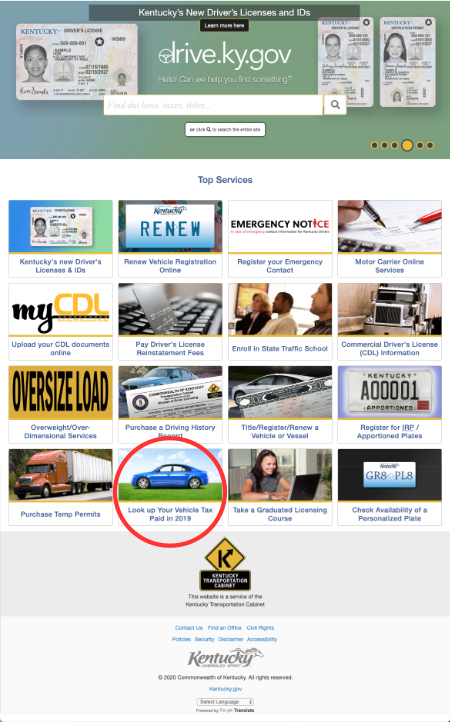

Every year Kentucky taxpayers pay the price for driving a car in Kentucky. The make model and year of your vehicle. Kentucky VIN Lookup Vehicle Tax paid in 2021.

Your household income location filing status and number of personal exemptions. Once you have the tax rate multiply it with the vehicles purchase price. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another.

Car tax as listed. For questions or to submit an incentive email the Technical Response ServiceFor additional incentives search the Database of State Incentives for Renewables Efficiency. It is levied at six percent and shall be paid on every motor vehicle.

Property taxes in Kentucky follow a one-year cycle. Estimate your car payment with our simple to use Loan Calculator. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Kentucky Vehicle Property Tax Calculator. 2000 x 5 100.

Kentucky has a 6 statewide sales tax rate but also has 211 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top. Kentucky has a 6 statewide sales tax rate but also has 226 local tax jurisdictions including cities towns. Financial guarantee bonds like tax bonds Freight Broker Bonds and Health Club Bonds have proven.

Search tax data by vehicle identification number for the year 2021. On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The date the vehicle entered or will enter the state you plan to register it in. 356 Big Hill Avenue Richmond KY 40475 859-624-2277. The tax is collected by the county.

Therefore car buyers get a tax break on trade-in vehicles and rebates in Kentucky. Where can I find my Vehicle Identification Number VIN. Kentucky Alcohol Tax.

In Kentucky the sales tax applies to the full price of the vehicle without considering trade-ins. For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. Non-historic motor vehicles are subject to full state and local taxation in Kentucky.

Our free online Kentucky sales tax calculator calculates exact sales tax by state county city or ZIP code. KRS 132220 1 a. Please enter the VIN.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. A 200 fee per vehicle will be added to cover mailing costs. Depending on where you live you pay a percentage of the cars assessed value a price set by the state.

This publication reports the 2020 2019 ad valorem property tax rates of the local governmental units in Kentucky including county city school and special district levies. Our calculator has been specially developed in order to provide the users of the calculator with not only. Kentucky Property Tax Rules.

Motor Vehicle Usage Tax. Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. For more information see page 2 of the Guide to Kentucky Inheritance and Estate Taxes.

Thus the taxable price of your new vehicle will still be considered to be 10000. Historic motor vehicles are subject to state taxation only. The date that you purchased or plan to purchase the vehicle.

Multiply the vehicle price before trade-ins but after incentives by the sales tax fee. If you are unsure call any local car dealership and ask for the tax rate. Payment shall be made to the motor vehicle owners County Clerk.

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Sales Tax On Cars And Vehicles In Kentucky

4 Things Every Borrower Needs To Get Approved For A Mortgage Loan In Kentucky Fha Va Khc Conventional Mortgage Loan In 2018 Mortgage Rates Today Mortgage Loans Conventional Mortgage

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Motor Vehicle Taxes Department Of Revenue

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Rising Value Of Vehicles May Lead To Property Tax Increase In Kentucky News Wdrb Com

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Kentucky Used Car Prices Taxes Jump 40 Start 2022 Fox 56 News

Taxes And Irs News Regulations And Scams Real Estate Agent Marketing Real Estate Agent Real Estate Advice

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Contractor Payroll Salary Packaging Novated Leasing Contractor Payroll Services Http Kentucky Nef2 Com Contracto Payroll Managing Your Money Contractors

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Liberty Tax Service Bookkeeping Tax Services Colorado Springs 481 Hwy 105w Suite 201 Monument Debt Relief Programs Credit Card Debt Relief Budgeting Money